YouLend

Fast Funding and Flexible Repayments

• Advances between £1,000-£1,000,000

• Funds sent to you in days

• No interruption to cash flow

• Expert team on hand to help you

• Repayments based on a fixed percentage of all your future card transactions.

What is it?

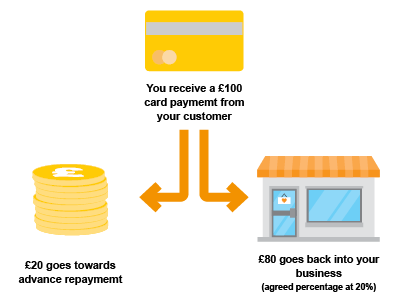

A business cash advance is repaid via your card machine or e-commerce site. When a customer pays by card, a fixed percentage of that transaction is used to repay the advance. This percentage stays the same regardless of the transaction value, so you’ll always repay proportionately with your cash flow.

Find out more and arrange funding.

How it works

Benefits

Unsecured funds up to £1m

Up to 2 x your average monthly turnover on card transactions.

Fastest route to funding

Typically 1-7 days from application to receiving funds.

Only pay back as you earn

Repaid as an agreed percentage of your future card sales.

Online tracking of repayment process

Full transparency of your finance facility.

No hidden fees

No late payments, monthly charges or hidden costs.

Easy to renew

More than 80% of customers renew their advance.

FAQs

What’s the criteria to qualify for a cash advance?

- Your business needs to have been trading for 6 months or more.

- You need to be accepting card payments either with a card machine or online via an e-commerce payment gateway.

- A minimum monthly turnover of £3,500 in card transactions is required.

How do I repay my cash advance?

Your advance is automatically repaid from your card revenue. When your customer pays by card either via your card machine or e-commerce site, a small fixed percentage of that transaction is used to repay the advance. This percentage is agreed when you sign up and will stay the same regardless of the transaction value, so you’ll always repay proportionately with your cash flow. This process will continue until the advance is fully repaid.

How much funding can I get?

The level of funding you could receive is dependent on your average card turnover. Typically, you could receive an advance of up to 2 x your average card turnover, so if you take £10,000 per month on cards you could be eligible for an advance of up to £20,000 in total.